GCC Revenue Projected to Soar 14% in FY25, Contributing 4.5% to India’s GDP | Bengaluru News

BENGALURU: When Nasscom first put out its IT services exports growth estimate for 2023-24 at 3.3%, it sounded fine, considering the biggest IT services companies were growing on average at roughly that level. But then came the Karnataka govt’s Economic Survey for the same year, which put IT services growth for the state at 12.6%. We were convinced the state’s bureaucrats had done a shoddy job. How can IT in Karnataka, a state that accounts for almost 40% of India’s IT, grow at such a high rate when the country’s IT industry was growing so slowly?

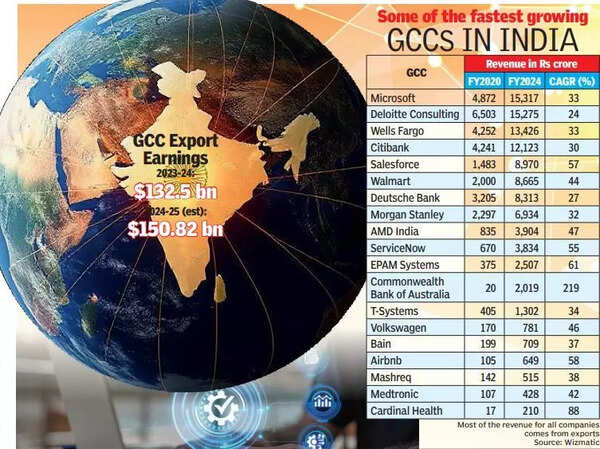

Later that year, we did a story based on work done by a consultancy in Pune called Wizmatic that had taken a different approach to estimating revenues of global capability centres (GCCs or tech & operations arms of MNCs). It put GCC revenue in 2022-23 at $103 billion, more than twice the Nasscom estimate for that year.

That provided a partial clue to why there was so much discrepancy between Nasscom’s and Karnataka’s numbers. Today, there is widespread consensus that Nasscom’s methodology for estimating GCC revenue needs a change. And Nasscom looks to be working on it. The organisation earlier this year also revised its IT industry growth estimate for 2023-24 to 9.9% – which brings it closer to Karnataka’s figures.

Since Wizmatic founder Sandeep Panat played a big role in the industry relooking at GCC revenue estimates, we are providing today his latest estimates for multiple years, including the estimate for 2024-25 ($151 billion exports, $178 billion total revenue, which is about 4.5% of India’s GDP. Details are in our graphic). His estimates show how fast some of the MNCs have been growing their India GCCs, particularly since the Covid period, when global organisations realised the criticality of digitalisation and recognised India as central to their ability to digitally transform themselves. It also shows foreign MNCs’ IT/ITeS revenue is now bigger than Indian IT/ITeS’s, and is one of the best things happening for India currently.

Panat’s work is based to a large extent on financial statements filed by foreign companies in India – some 1,800 of them – with the registrar of companies (RoC). He says the financial filings clearly distinguish between the GCC entities of MNCs, and their entities for India sales. He says they also provide details of export earnings of GCCs and their rupee earnings from local contracts.

Some disagreements

Many believe Panat’s methodology brings a lot of value. Manoj Marwah, financial services GCC consulting leader at EY India, who has worked with Panat to do an estimate of revenues for financial services GCCs, says you cannot get more accurate than with the use of company filings with the ministry of corporate affairs.

But some disagree on parts of Panat’s work. The most controversial is his inclusion of the India centres of foreign IT services companies like Accenture and Capgemini in the GCC category. Even if these companies are excluded, Panat’s GCC figures are much higher than Nasscom’s (GCC exports of $111 bn for 2023-24 and $128 bn for 2024-25). Panat’s argument is that there is nothing to distinguish the way an Accenture or Capgemini’s India centres operate from the way the other GCCs do – be it the nature of work, the delivery, the objectives, the pricing.

But Lalit Ahuja, founder & CEO of ANSR, the consultancy that’s helped over a hundred GCCs to establish themselves in India, says a GCC should be defined as a subsidiary of a traditional company that has employees in India and that is doing work only for that company. Shalini Pillay, India Leader for GCCs in KPMG India, agrees. “The minute you call yourself a centre, then you are a centre delivering to some headquarters. If you look at the genesis of the model, you are an extension of the global organisation taking advantage of talent and what the geography has to offer. Now, you cannot see a service provider’s operation as an extension of the parent in that sense, they are always going to be a service provider,” she says.

Ahuja and Shalini also note the use of BOT (build, operate, transfer) models being used by IT service providers to establish GCCs in India. These, they say, should probably be part of GCC revenue. Ahuja questions the calculation of GCC revenue based on the entire cost incurred plus transfer pricing. Revenue, he says, should be actually based on people who are doing productive work (not support activities like HR, payroll) and how much they are earning.

Ahuja has started an exercise to look at all such changes and nuances, and come out with an altogether new estimate for GCCs. That report, he says, should be ready in three months. Many, including us, will be looking forward to it.

——————

GCC is a very loosely used word now. The time has come to have one consistent definition. We’re coming out with a different definition of GCC – as a subsidiary of a traditional company doing work only for that company. So a services company is not a GCC. And we’ll look at the 500 largest global companies, the 2,000 largest ones, the global 5,000 to see which markets are growing, and where the bulk of the revenues lie. We expect to have that report in three months. The report will consider two other important aspects. GCCs are today also becoming platforms for managing the service provider. And both the GCC and the vendor are reporting this work as their revenue. So there’s double counting happening. There are also a large number of BOTs in service providers employing tens of thousands of people. That should be part of GCC revenue.

Lalit Ahuja, Founder & CEO, ANSR

There is a need to look into the estimation of GCC revenue with a more critical lens, given also the changes that are happening. For instance, every service provider now has realised that the threat from GCCs is real, and they are pivoting more and more towards the GCC model. They are telling their clients, I’m anyway running an ODC (offshore development centre) for you, why don’t I make that a BOT (build, operate, transfer) model? I have 500 people dedicated to your account, that will be the basis for you to build your GCC. I’ll help you set up a GCC. By doing that, they’re holding onto that revenue for a little longer. Should you then not be counting that part of the service provider revenue as GCC revenue is the question.

Shalini Pillay, India Leader – Global Capability Centres, KPMG India

People have broadly used $40,000 as the average revenue per employee in a GCC, and multiplied that with an estimate of the number of employees to get the overall GCC revenue. But the reality today is very different. In financial services GCCs, for instance, there is so much high-end, complex, global end-to-end work happening that the average revenue per employee in some of them is $75,000 to $90,000. Earlier, there would be 3-4 MDs in a 10,000 people centre, now there are 90-100 in similar sized centres, and an MD salary in a large financial services centre would be between $500,000 and $1 million. The number of executive directors would be 4-5x the number of MDs, and they would be getting an average salary of $250,000.

Manoj Marwah, Business Consulting Partner, EY India

The GCC landscape in India is evolving fast – with hybrid delivery models, profit-centre setups, and new types of tech hubs entering the mix. Legacy methods that rely on sampling or extrapolation often miss this nuance. We are taking a bottom-up approach to sizing the GCC industry. We aggregate company-level data – tracking over 1,800 foreign MNCs. Our models are built using actuals: financial filings, export performance, employment disclosures, and verified business activity.

Sandeep Panat, Founding Partner, Wizmatic Consulting