Government using 99% borrowings for capex in FY26, says FM

NEW DELHI: Government is using entire borrowed resources for financing effective capital expenditure, creating capital assets, finance minister Nirmala Sitharaman said on Tuesday, asserting that money was not being denied to any of the capital expenditure accounts.

“Govt intends to use about 99% of borrowed resources to finance effective capital expenditure in the upcoming year 2025-26,” Sitharaman said in her reply to the Budget discussion in Lok Sabha. She said the effective capital expenditure was 4.3% and the fiscal deficit was 4.4% of GDP in 2025-26, which indicated govt spending was directed towards building capital assets.

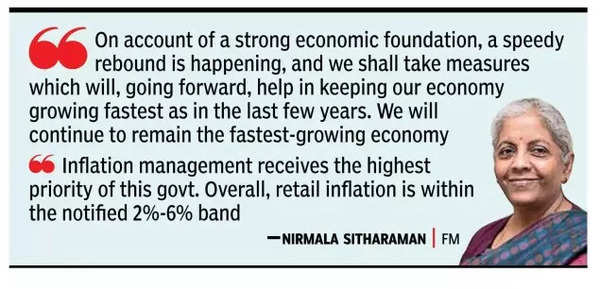

FM also said that the trend of inflation, particularly food, appeared to be moderating. “Inflation management receives the highest priority of this govt. Overall, retail inflation is within the notified 2%-6% band,” Sitharaman said.

FM said the economic growth was witnessing “a speedy rebound” from the 5.4% recorded in the second quarter of the current fiscal year and said the govt will take all measures to ensure that the country remains the fastest growing major economy in the world.

“On account of a strong economic foundation, a speedy rebound is happening, and we shall take measures which will, going forward, help in keeping our economy growing fastest as in the last few years. We will continue to remain the fastest-growing economy,” FM said, adding that the private final consumption expenditure is estimated to grow by 7.3% in the current fiscal year, riding on robust rural demand. The Indian economy is estimated to grow by 6.4% in the current fiscal year against the backdrop of global challenges and geopolitical tensions.

Sitharaman also said several global and domestic factors are influencing the value of rupee against the US dollar and detailed data to show that Indian currency has depreciated 3.3% against the US dollar between Oct 2024 and Jan 2025, but the slide has been lower compared to other Asian currencies. The South Korean Won and the Indonesian Rupiah had depreciated by 8.1% and 6.9%, respectively, during the same period while all G-10 currencies had depreciated by over 6% with euro and British Pound sliding by 6.7% and 7.2%, respectively.