Warburg Pincus in talks to sell its 26% stake in IndiaFirst Life

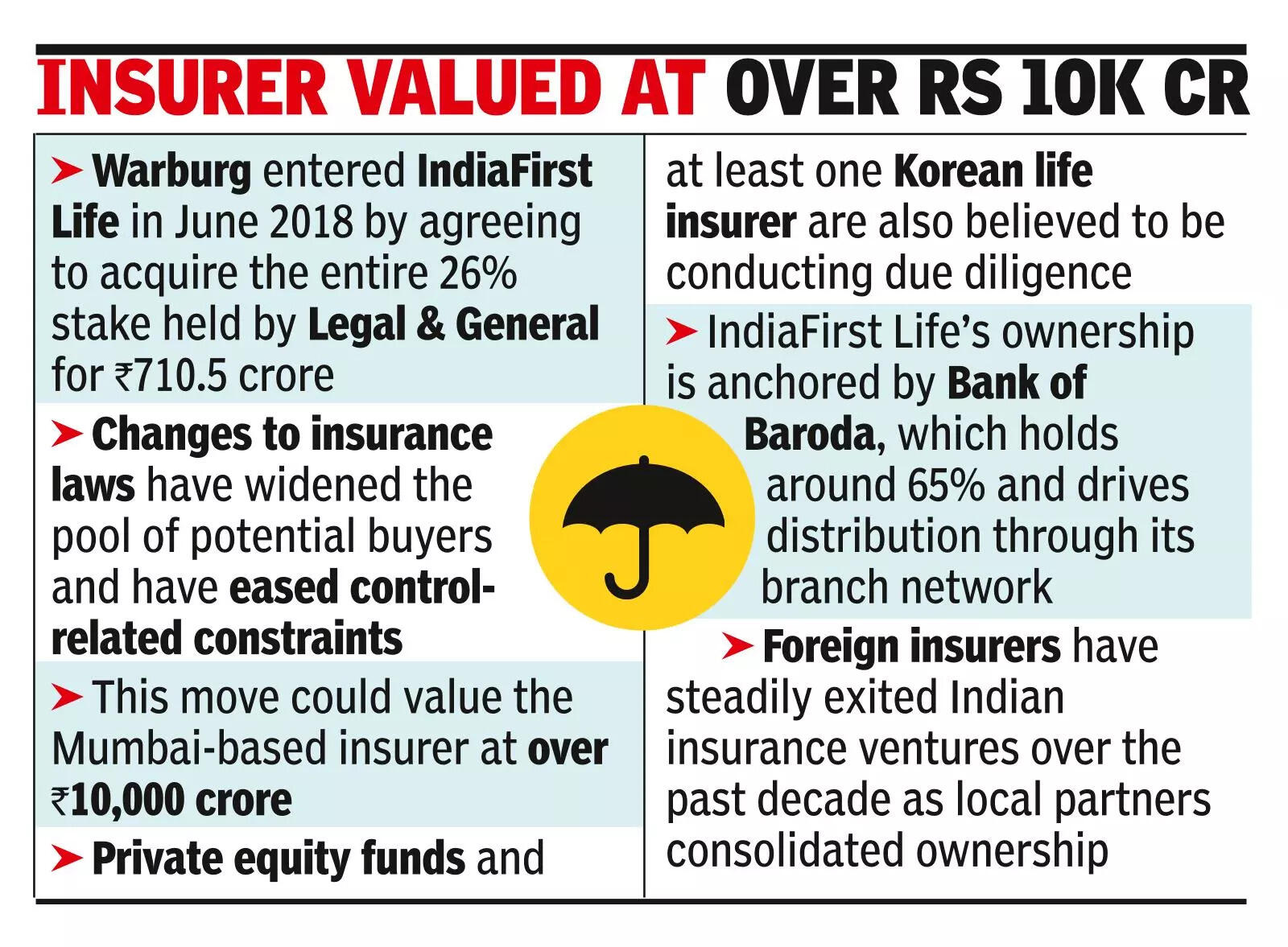

MUMBAI: Warburg Pincus is in talks to sell its 26% stake in IndiaFirst Life Insurance, a move that could value the Mumbai-based insurer at over Rs 10,000 crore, as changes to insurance laws widen the pool of potential buyers and ease control-related constraints.The private equity firm, through its affiliate Carmel Point Investments India, holds about 26% in the insurer and has received interest from several suitors, including strategic investors and private equity funds. The sale would rank among the larger secondary transactions in India’s insurance sector, coming after a planned IPO was deferred due to market volatility.Warburg entered IndiaFirst Life in June 2018 by agreeing to acquire the entire 26% stake held by Legal & General for Rs 710.5 crore, completing the transaction in early 2019. Legal & General, which had been a promoter since the insurer’s launch in 2010, exited to refocus on other markets, giving Warburg a foothold in a bancassurance-led life insurer.Strategic interest has been led by Prudential Plc and BNP Paribas, while private equity funds and at least one Korean life insurer are also conducting due diligence. Buyers have been encouraged by recent sector benchmarks, including the listing of Canara HSBC Life.

Interest has been sharpened by the Sabka Bima Sabki Raksha (Amendment of Insurance Laws) Bill, 2025, which Parliament passed this month. The amendments raise the foreign investment limit in insurance companies to 100% from 74% under the automatic route, and relax several operational and governance requirements. According to market participants, the changes give foreign buyers greater flexibility on board composition, management control and future stake consolidation, making transactions easier to structure.IndiaFirst Life’s ownership is anchored by Bank of Baroda, which holds around 65% and drives distribution through its branch network. Union Bank holds about 9% after the merger of Andhra Bank and a subsequent stake sale to Bank of Baroda that received competition approval in 2023.