Not Mumbai, not Delhi: This city offers the best returns on real-estate investments

The Union Budget 2026, presented on Sunday, brought focus on where India’s real estate growth is headed, with data suggesting a gradual shift beyond the country’s biggest metropolitan markets. While Mumbai and Delhi continue to make headlines for Rs 100-crore-plus home sales, industry data shows that the best returns on property investment, on average, are increasingly coming from cities outside India’s traditional metro hubs.Mumbai, Delhi and other metros are often in the news for ultra-luxury transactions. However, recent analysis showed Bhubaneswar emerged as the top-performing city in long-term residential price appreciation. Other markets that have also outperformed several large metros include Gurgaon, Navi Mumbai and Greater Noida, showing a broader shift in investor returns away from India’s traditional urban cores.

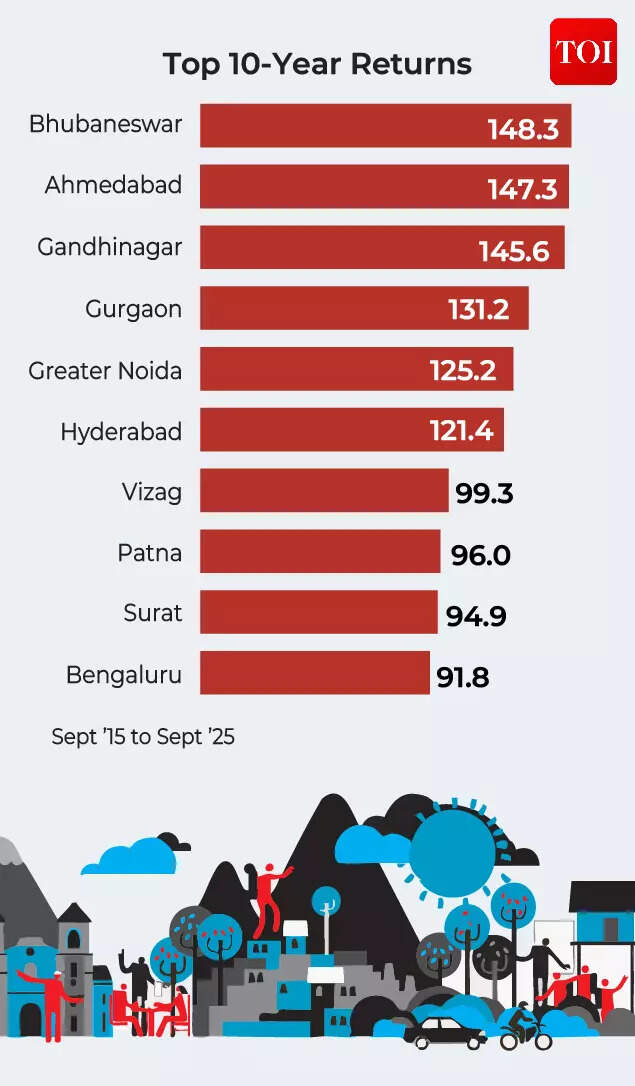

Over a 10-year period, real estate returns clearly favour non-metro and emerging cities over India’s biggest urban centres, as per the data from National Housing Bank’s RESIDEX for September 2015 to September 2025. Bhubaneswar recorded the highest returns of 148.3 per cent during the recorded period, followed by Ahmedabad at 147.3 per cent and Gandhinagar at 145.6 per cent. Among metro-linked markets, Gurgaon and Greater Noida posted returns of 131.2 per cent and 125.2 per cent respectively, while Bengaluru remained below the 100 per cent mark over the same period.

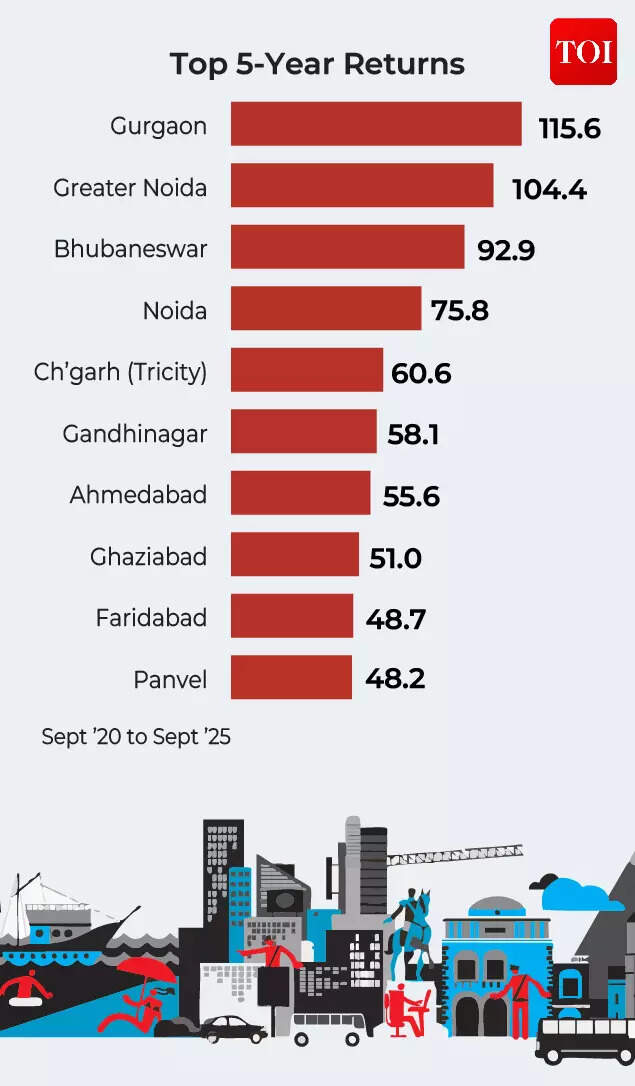

The five-year data reinforced this shift to some extent. Gurgaon reported returns of 94.1 per cent, followed by Greater Noida at 76.1 per cent and Bhubaneswar at 57.7 per cent. Other cities such as Noida, Chhattisgarh’s tri-city region and Ghaziabad also recorded gains during this timeframe.

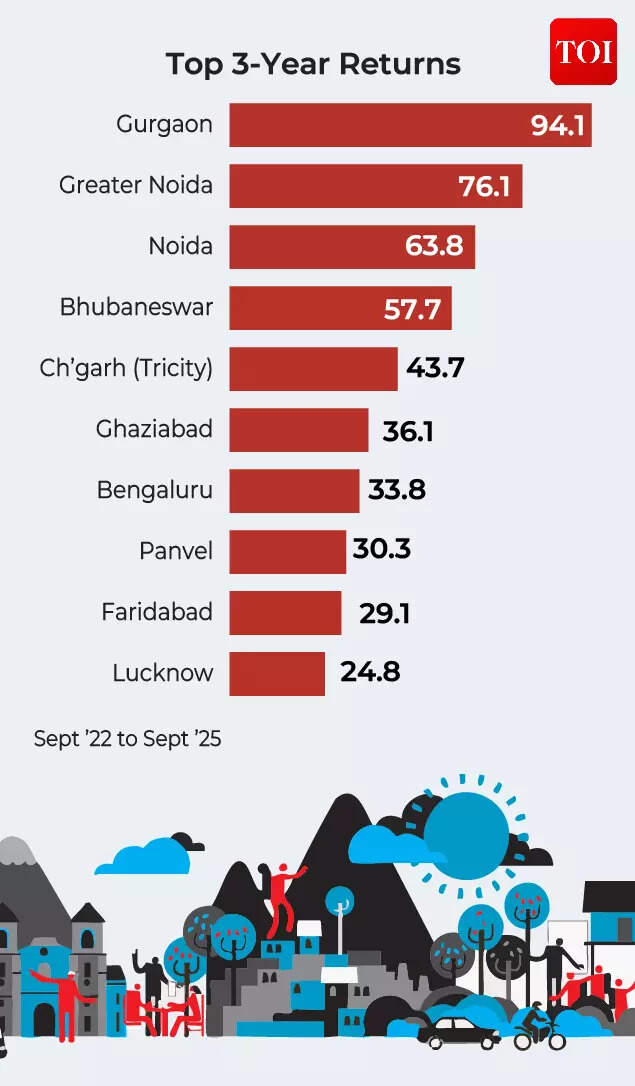

Shorter-term trends broadly mirrored this pattern. In the three-year window, Gurgaon (94.1 per cent) and Greater Noida (76.1 per cent) dominated, while Bhubaneswar remains a consistent performer.

One-year returns showed a similar bias, with Gurgaon leading with a return of 25.9 per cent. Navi Mumbai and Greater Noida followed with returns of 23.9 per cent and 23 per cent respectively, while Bengaluru recorded a return of 11.3 per cent, trailing several smaller and peripheral markets.

Budget 2026: Mixed response from real estate sector

Looking at the Budget for FY 2026-27, the real estate sector gave a mixed response to the Union Budget. While developers and analysts welcomed the government’s sustained focus on infrastructure development, industry bodies expressed disappointment over the absence of targeted policy support for the affordable housing segment.Industry body CREDAI said the lack of incentives for affordable housing could further erode its share in the overall housing market. The apex realtors’ association, which represents nearly 15,000 developers across the country, said the Budget failed to address long-standing challenges facing the segment. “Deeply disappointed that the Budget offers nothing concrete for affordable housing,” CREDAI National President Shekhar Patel said. According to Patel, rising construction costs and escalating land prices, in the absence of matching policy intervention, are making affordable housing projects increasingly unviable for developers.Even as it flagged concerns over affordable housing, CREDAI welcomed the government’s continued thrust on infrastructure creation. The association said investments in highways, metro rail projects, logistics corridors, railways and urban infrastructure would strengthen connectivity and open up new growth corridors.Giving an overall outlook on the sector, Jeffries also said, “The real estate sector stands to benefit from tax incentives for data centres and relaxed safe harbour norms for global capability centres (GCCs), which should support office demand and REITs. However, a rise in bond yields could weigh on sector valuations.”Meanwhile, Navin Dhanuka, Director at ArisUnitern, told TOI, “The emphasis on infrastructure, City Economic Regions and industrial corridors creates a virtuous loop between jobs, housing and urban expansion,” Dhanuka said. “By widening the geographical footprint of cities, the Budget enables housing growth beyond saturated urban cores into well-connected peripheral and Tier-2 markets,” he added.Bhavesh Kothari, Founder & CEO, Property First Realty also had an optimistic outlook. “A committed Rs 5,000 crore annual allocation for City Economic Regions and continued emphasis on Tier-2 and Tier-3 cities are likely to reshape development patterns, easing pressure on metros and unlocking housing demand in new corridors. “Adding his insights, Aman Sharma, Founder and Managing Director, Aarize Group said, “The Union Budget 2026 sends a strong, reassuring signal to the real estate and infrastructure ecosystem. The focused allocation for Tier-2 markets recognises where India’s next major real estate opportunity will take shape.”He added that the introduction of the Infrastructure Risk Guarantee Fund would help unlock long-term capital and reduce execution risks for large-scale projects, while the continued thrust on infrastructure would improve connectivity and create a virtuous cycle for housing, industry and employment, restoring developer confidence to plan and invest for sustainable growth.