Investors see growth in single-specialty hospitals

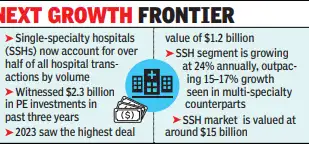

NEW DELHI: With traditional multi-specialty hospital chains nearing deal saturation, investors are increasingly shifting their focus on single-specialty hospitals (SSHs), which are fast emerging as the next growth frontier in India’s healthcare landscape. Offering focused care, operational efficiency and faster scalability, SSHs have become particularly attractive to private equity (PE) firms, analysts told TOI. This shift is reflected in deal activity: SSHs now account for over half of all hospital transactions by volume, supported by $2.3 billion in PE investments over the past three years, according to data from Grant Thornton Bharat. Over the past decade, deal volumes in India’s single-specialty hospital segment remained steady, peaking in 2023. The year 2023 saw the highest deal value of $1.2 billion, largely driven by landmark transactions such as BPEA EQT’s investment in Indira IVF and Quadria’s strategic investments in Maxivision and NephroPlus.

Next growth frontier

Sunil Thakur, partner at Quadria Capital, says, “Projected to more than double to $9 billion by 2028, organised single-specialty networks offer compelling economics, (>20% earnings before interest, taxes, depreciation, and amortisation, 20-25% return on capital employed) powered by deep specialisation and rapid access expansion. The momentum is evident from the fact that over $3.5 billion of PE capital has flowed into the segment in recent years.“The segment is growing at a robust 24% annually – outpacing the 15-17% growth seen in multi-specialty counterparts -indicating strong investor confidence. Key specialties driving this growth include, in vitro fertilisation (IVF), women’s and child care, eye care, nephrology, and oncology – each witnessing substantial deal activity.“Investor interest in the segment has remained consistent, though we are yet to see a large-value deal in 2025. Strong fundamentals, including healthy margins, better unit economics, scalability, asset-light models, and quicker break-even cycles, continue to attract both strategic and financial investors. As healthcare delivery expands beyond metro cities, single-specialty formats are increasingly seen as effective platforms for regional growth,” says Bhanu Prakash Kalmath SJ, Partner and Healthcare Leader, Grant Thornton Bharat.Valued at approximately $15 billion, the SSH market includes an organised segment worth around $4 billion, which continues to gain scale through consolidation and network expansion. The focus on single-specialty hospitals is a global phenomenon, reflecting a broader shift towards specialised, efficient healthcare delivery, experts say.Vishal Bali, executive chairman Asia Healthcare Holdings, a platform focused on single-specialty hospitals, backed by TPG and Singapore-based GIC, says: “We strongly believe that one of the key prescriptions to bridge India’s demand-supply gap in healthcare delivery sits with SSH enterprises.”